So a lot of Oppo’s have made comments about my car insurance costs both on Oppo and during Oppo meets. I thought I would make a post that explains why BC is an expensive place to insure a car.

Below are my rates & coverage. If you want to see what the base cost of insurance is in this province, the Dodge Ram carries the lowest legal amount, then add 40%. This base rate is the same for EVERY citizen in BC.

ICBC is sold via independent brokers on commission and they also manage the registration/licensing of vehicles and people in BC.

2014 Ford Fiesta ST

Premium for 2018-2019 = $2079.00

Coverage: $2M Liability Limit, $300 comprehensive & collision/upset deductible. To and from work more than 15km*.

*Will change to “pleasure use only” should save about $300-$500.

Discount: 40% (max) safe driving.

2016 Mazda CX-3 GT

Premium for 2018-2019 = $2254.00

Coverage: $2M Liability Limit, Roadstar (roadside assistance, loss of use & rental coverage) $2M UMP (Underinsured Motorist Protection) and $300 deductible for comp/collision. To and from work more than 15KM.

Discount: 40% (max) safe driving.

2018 Kia Forte LX

Premium for 2018-2019 = $2752.32

Coverage: $2M Liability Limit, $2M UMP, $300 ded. for comp/collision with replacement cost*. Business use.

*replacement cost via private insurance.

Discount: 40% (max) safe driving.

1986 Dodge Ram D100

Premium for 2018-2019 = $1200

Coverage: $200K Liability Limit*. Pleasure use only.

*minimum legal limit in Canada**.

**Excluding Québec, but...that is a different lesson for a different day.

Discount 40% (max) safe driving.

So. Now we have all that unpleasantness out of the way. Your main question is probably, why is insurance so expensive in BC?

We, like you, have mandatory minimum limits of liability coverage. Our min. limit is $200,000CDN. This must be purchased from our government owned/run insurance monopoly, ICBC. Anything above that for liability, collision or comprehensive insurance can be bought from ICBC or the free market.

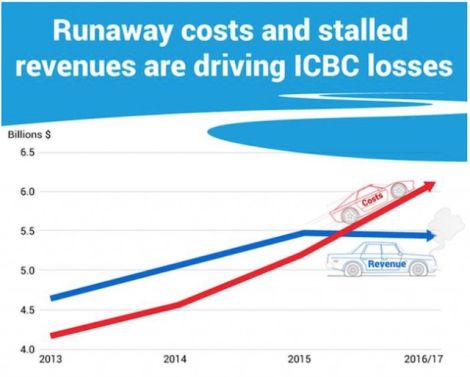

In the last few years, due to our very litigious province, increasing rates of fraud and increasing vehicle repair costs, ICBC has been losing money. Like... a lot of money. In the first 9 months of the 2018 fiscal year, ICBC has already lost $935 million dollars.

This has lead to yearly increases of the base rate of insurance, but it still cannot keep up. The causes of this fraud/repair cost increase is loosely tied to more general trends in Vancouver. Money from China is a big driver, with high end cars in excess of $150K MSRP being the biggest cost for repairs paid by ICBC.

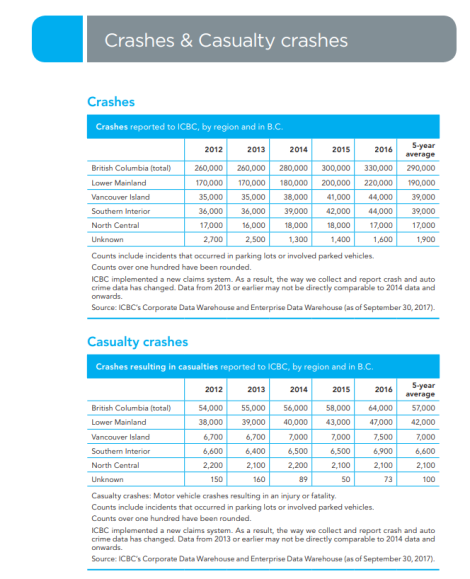

Crash rates in BC have also increased dramatically, some feel that increased foreign drivers contributes heavily to that, but there is no data to show this.

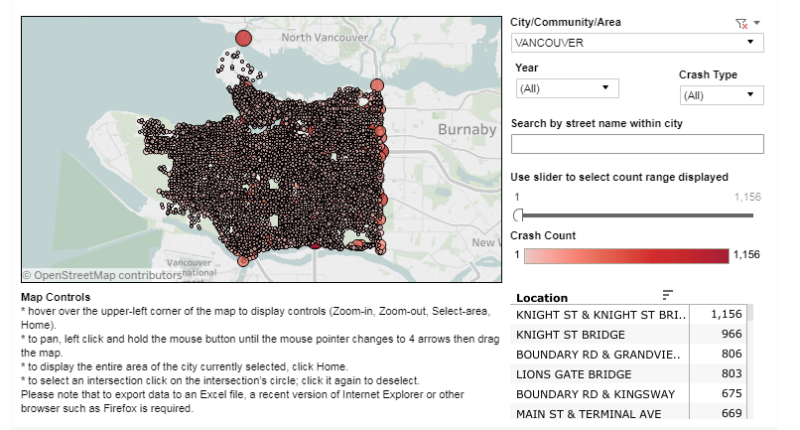

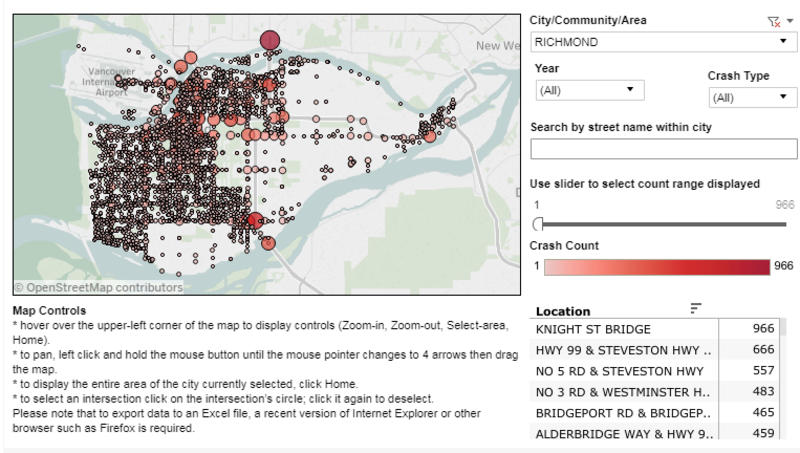

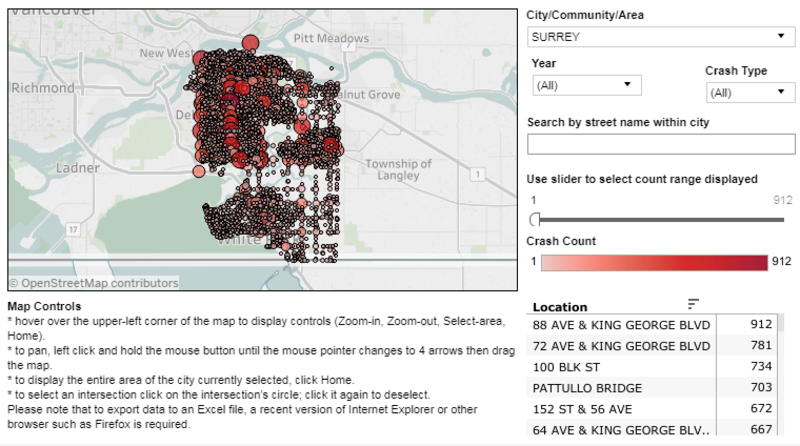

Here you can see a few of the biggest crash areas in Metro Vancouver.

I have no way to wrap this article up other than to say that fiscal mismanagement, government unwillingness to pass legislation limiting injury claims and increasing fraud/repair costs make this province unbearably expensive insure a car in.