As some of you know, I like to share the more interesting aspects of my job. Adjusting isn’t just about homeowners claims and auto. I like to position myself as more of a “bespoke” adjuster handling more interesting files.

I hope that people find this interesting and that it changes perceptions of what adjusting can look like.

Forgive my possibly overzealous redacting, but better safe than sorry.

A big part of my job is investigative in nature. Like a criminal investigation, my role is to investigate, document and prepare for court. Unlike a criminal investigation, we’re typically on the defense side and the burden of proof in a Civil Court is on a “balance of probability” rather than “beyond a reasonable doubt”.

A lot of what I do involves forensics. Fire investigations, product liability investigations or other specialized matters.

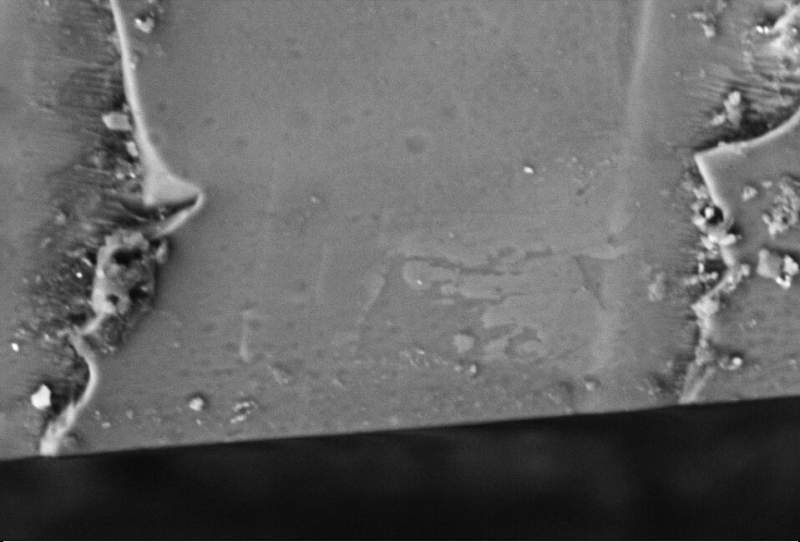

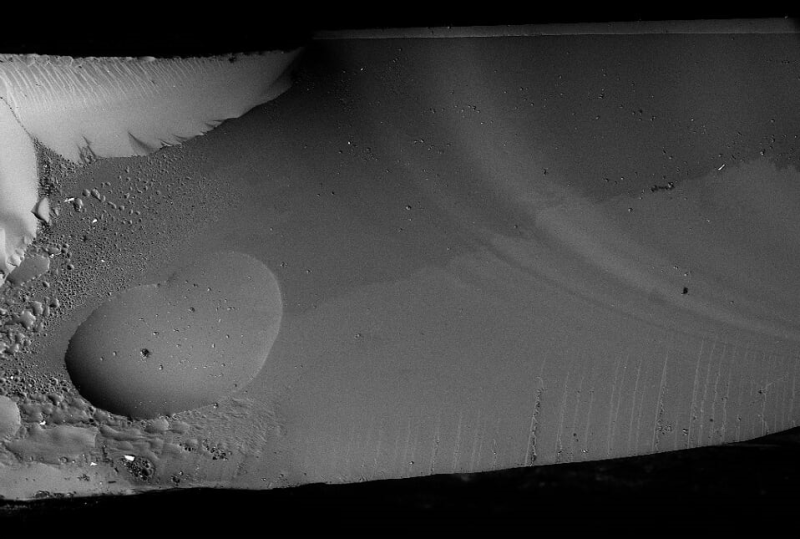

Today I was at a laboratory participating in examination of some evidence in an ongoing claim. The analysis involves metallurgical testing, microscopic investigation and the creation of silicon replicas of certain key pieces of evidence.

Laser scanners are used to acquire highly detailed images of evidence and specialized software to analyze, measure and classify certain pieces of evidence.

Other investigations that I have been involved with involve DNA or material testing of foreign objects, electron microscope examination of minute cracks in glass in a heating element.

It is interesting as the things we typically examine are quite mundane. Perhaps a thermostat, length of cable, chicken nuggets.... But when we’re talking thousands, hundreds of thousands or even millions of dollars of potential loss, things get quite detailed.