I mentioned that I changed my strategy from salary driven to savings focused. Last April, with this new mindset, I stopped working locally and took on a fulltime nationwide travel position because I saw an opportunity to not only be more visible but also have a multi-million dollar company pay for my Zebra Cakes habit. After 45 days, I realized that I had completely underestimated the brilliantly brutal bureaucratic beaver buster that is outdated corporate expense reporting.

It started out rough because the expense system took 6+ weeks to reimburse from filing to deposit and the expenses could only be submitted after the trip ended. So, if I worked June 3rd to June 24th (one long trip), I would submit on the 25nd and be reimbursed around August 9st. At which point, I would have paid for all of June, July, and part of my August trip by the time I saw cash back for the June trip! Weathering that kind of torment like an On-the-Scene redshirt reporter in Louisiana is really what got me supercharged on finances.

The great news is that I received a corporate card back in January! *Finger guns (pop pop pop)* Unfortunately, this has been such a big change that I have transformed from an average guy, with an average salary, trying to do ordinary things into an average guy, with an average income, in an exceptional situation trying to do extra-ordinary things. Here are the main work perks and features (there’s more but the bullet points would become missile sites by the time I explain them):

- Per Diem for food (while out of state).

- Fuel Card (87 Octane Unleaded Only).

- Car Allowance ($112.50 a week)

- I keep all Airline, Hotel, and Rental Car rewards.

- I’m only home 4-8 days a month so I can live on most people’s beverage budgets and I dont put many miles on my cars. I do still get the allowance because beaucractic systems deal in disparate dollars, not common sense.

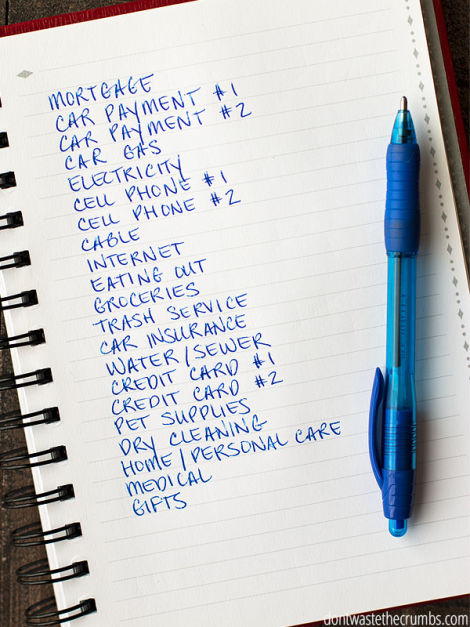

As far as my “at home” expenses go, I mentioned that I have been killing off recurring monthly payments everywhere I can because I wanted to move from:

- Day-to-Day (cash) living to,

- Week-to-Week (paycheck) living to,

- Month-to-Month (credit card) living to finally,

- Year-to-Year (retirement) living.

I dropped my personal phone and now use my work cellphone so that I no longer have a phone bill. This is why I’m not around online much anymore.

I will continue to rent for a few more years because I’m gone too much to be responsible for a home, plus renting gives me the option of paying off my lease year-to-year (this is a HUMONGOUS benefit for saving up cash). It’s one of those situations in which the math on paper and the math in practice are diverge due to the Psychology of On-Hand Capital (coming to a Barnes and Nobles near you if those still exist in the future).

The goal of nearly every hustle, degree, or budget strategy is to have more money in your hands each month, I’m just doing the deconstructed digest version.

All and all, my current reoccuring monthly spending for the year is as follows:

- $375 car payment (which will go away in November).

- $300 across utilities, gym membership, food when I’m home, and random things like entertainment, clothes, cleaning, and so forth. No subscriptions, cable, internet, or anything interesting since I’m rarely home.

After the Jeep is paid off, I’ll enter 2020 with $300 of reoccurring month-to-month spending. The car allowance covers this so I’ll be saving 100% of my net monthly salary (but not really because it goes to rent, insurance, and non-reoccuring expenses). Plus, I dont want to get into a habit of not spending any money and turning into a miser. In fact, I find that making things challenging forces me to find new ways to arrive at difficult places to get to.

I’ll still find something — *cough* GranTurismo *ackem* marry my best friend and have lots of babies *hack* — to place a specific amount of income towards. Thus, going into 2020, that’s what’s up and if you aren’t down with that then I’ll catch you on the flipside, ungh!